Hedge Fund Average Annual Return: 5 Year View

In this post, I'll show the overall hedge fund average annual return based on the Hedge Fund Research data and then give you all the details on how to start a hedge fund, including how much you need to start a hedge fund.

1. Hedge Fund Average Annual Return

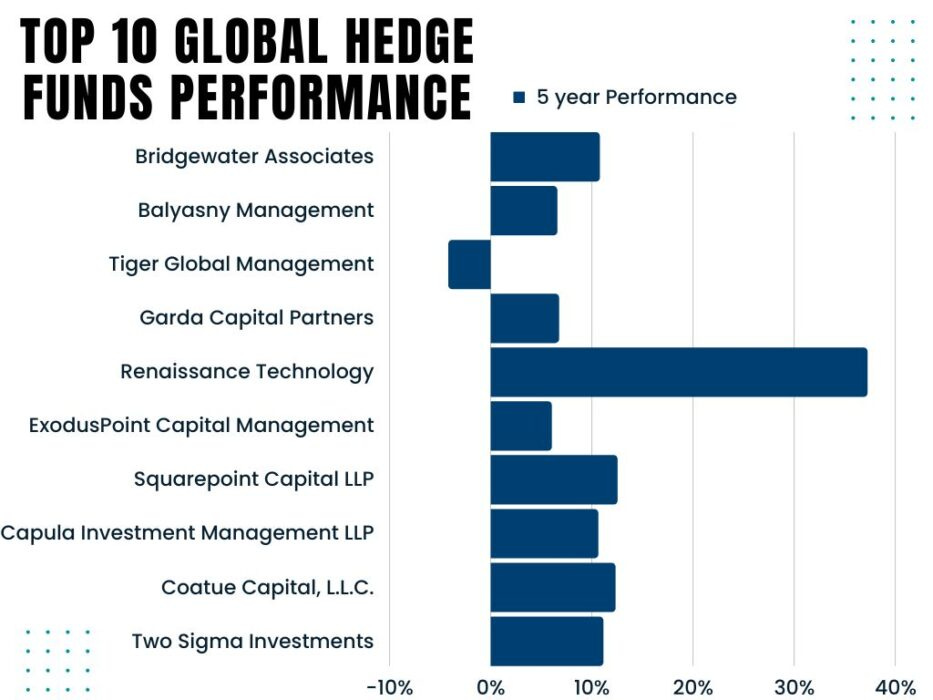

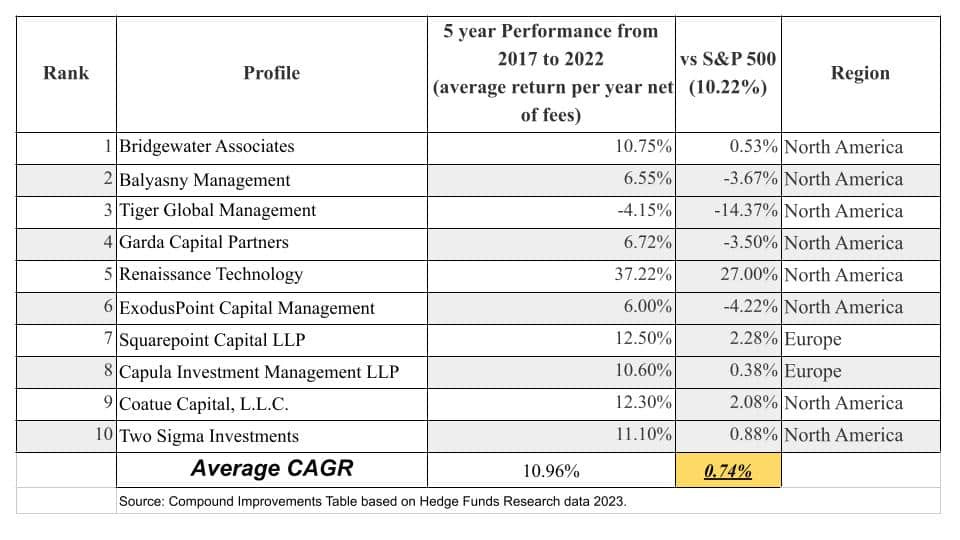

The average compounded annual growth rate (CAGR) after taking all of the fees across the top 10 hedge funds over the last 5 years has been 10.96%.

It seems like a great performance, considering this is after taking the fees out of the equation, which most do have a 2:20 fee model, which I'll explain later in this post.

That being said, if you pay closer attention to the graph, you'll notice that Renaissance Technologies is the outlier. Having achieved 37%+ returns after fees, it brings the hedge fund average annual return up tremendously.

2. Hedge Funds Average Returns vs S&P 500

When comparing the hedge funds average returns vs the S&P 500 index, the net result is a measly 0.74%.

If you taking about billions, then 1% of $100 billion is still a $1 billion so the fact that the top 10 hedge funds on average outperform the S&P 500 over the last 5 years is a good thing.

But, if you took Renaissance Technologies out of the equation, the result would be very different.

This data was provided by Hedge Funds Research and compiled by Compound Improments.

3. The reality of hedge funds performance

First of all, I need to be honest with you.

Most hedge funds fail.

Don't believe me?

Here are the main stats.

There are more closures of hedge fund than openings.

Here's how to reduce the chance of failure in your hedge fund.

Causes of Operational Risk in Hedge Fund Failures

Still, feel like you want to start a hedge fund?

Here's what is needed to start your own hedge fund:

1) A lawyer to draft the partnership agreement template and register each partnership: a lawyer charges $650 per LLC to create all paperwork, filing fees and the custom operating agreement included. A lawyer's retainer is a minimum of $2,500 on top of $650 per LLC.

Thus, a realistic cost per person in the LLC is $1k so factor that into the minimum amount of money you would accept for a partnership.

2) A brokerage account to trade

3) An accountant/company secretary to provide financial reports for tax purposes.

None of these is expensive and overhead can be extremely low. The next steps are to figure out what legal structure the partnerships take, your pitch and what your fee structure could be.

Your track record and recommendations from existing partners will drive your AUM growth.

Basically, the investment partnership company is a Limited Partnership (LP), and the funds it controls are Limited Liability Partnership (LLP).

Regulations and registration

You do not need to register as an Investment Adviser with the SEC because you would have less than US$25m in AUM in your hedge fund.

You may need to register with your state; a lawyer will guide you.

Management fees on Investment Funds

The fund management industry standard is 2 and 20 which means 2% management fee per year of AUM and 20% of upside above the hurdle rate. A hurdle rate is usually what is considered a minimum safe investment in the market that the investor would take if he simply put the money in an index bond fund and left it there.

How much do you need to start a hedge fund?

Let's say you are able to raise $1,000,000 from your personal savings, family and friends. And you had a great performance of +15% in your first year. Let's also assume that your hurdle rate is 6%. Anything above that, you'd also take 20% of fee.

You would charge 2% of the total $1M = $20,000 plus 20% of (15% - 6%) = $18,000. Your total revenue would be $38,000 for your first year. While your costs would be at minimum $10,000 to set it up and work from your own flat.

Note that this is for 1 year of investing $1,000,000 for others. Not profitable, but it is still a way to start building a track record. By building a track record, you can then focus on attracting further investors.

You'll probably want to invest in sales people for your hedge fund so that the right wealthy investors know that you exist.

To earn gross revenue of $380k per year before taxes, you would need to have AUM of $10m and keep your stellar performance.

Different paths to build a hedge fund

There are multiple path on how to start a hedge fund and here are some of them in order of easiness of achieving success in the hedge fund industry:

Build a career in the financial industry, preferably already in a hedge fund. This is the best option for obvious reasons. You are already networking with your potential clients. Not only that, but many hedge funds provide seed money for their amazing and loyal employees to strike on their own one day. It is a common way to support their "babies" and diversify their portfolio.

Build a career in management consultancy or investment banking, and then strike independently. You are already rubbing shoulders with wealthy people who know the quality of your work.

Be born & raised in a wealthy family. You will have the right connections and the proper funding from the get-go.

Become an entrepreneur in another field, exit with millions, and open your hedge fund. That's what Peter Thiel did after selling Paypal.

Start small on your own and build it from there gradually.

For most of us, the number 5 is the most feasible option.

If that's you, don't wait until you have $1M to start. Keep your day job, take the first $10k from friends, family members and mentors, and get going now.

Build the track record one small step at a time and let the returns speak for themselves. The sustainable scale comes with delivering returns.

Don't focus on the loss you incur at the start because it is a long-term investment in your future, and every business has some startup costs. However, try to get scale within 2 years so you can focus full-time on the hedge fund.

Your 2-year target should be $5m AUM. If you fall 50% short, you will still earn $80k net per year).

There you have it: How to set up and start your own hedge fund. Drop a line in the comments if you liked this post.

Newsletter

Sign up for our monthly newsletter here for more content in your inbox.

Frequently Asked Questions

Can you start your own hedge fund?

Starting a hedge fund involves several steps and typically requires a combination of financial, legal, and operational considerations. Here is a general overview of the process:

Educational Background and Experience:

Gain a solid educational background in finance, economics, or a related field.

Acquire relevant work experience in the financial industry, preferably focusing on asset management and investment strategies.

Professional Certifications:

To enhance your credentials, consider obtaining relevant certifications, such as the Chartered Financial Analyst (CFA) or Certified Public Accountant (CPA).

Build a Track Record:

Develop a track record of successful trading or investment management through personal investments or working for established financial institutions.

Create a Business Plan:

Outline your investment strategy, target market, and the structure of your hedge fund.

Include details on risk management, fee structures, and marketing plans.

Legal Structure:

Choose a legal structure for your hedge fund. Typical structures include limited partnerships or limited liability companies.

Consult with legal professionals to ensure compliance with local and international regulations.

Registration and Compliance:

Register your hedge fund with relevant regulatory authorities. This often involves filing with the Securities and Exchange Commission (SEC) or state securities regulators in the United States.

Comply with all applicable securities laws and regulations.

Service Providers:

Select service providers, such as administrators, auditors, and prime brokers, to support your fund's operations.

Establish relationships with banks and custodians for handling fund assets.

Technology Infrastructure:

Set up the necessary technology infrastructure for trading, reporting, and managing the fund's operations.

Marketing and Fundraising:

Develop a marketing strategy to attract potential investors.

Comply with regulations related to advertising and solicitation.

Launch and Operations:

Launch your hedge fund and begin implementing your investment strategy.

Continuously manage and monitor the fund's performance, keeping investors informed through regular reporting.

Risk Management:

Implement robust risk management practices to protect both the fund and its investors.

It's crucial to note that starting a hedge fund involves complex legal and financial considerations, and seeking the guidance of legal and financial professionals is strongly recommended throughout the process. Additionally, regulations and requirements may vary based on your location, so it's important to be well-informed about the specific rules that apply in your jurisdiction.

Can I start a hedge fund with my own money?

Yes, it is possible to start a hedge fund with your own money, and this is often referred to as a "self-funded" or "seeded" hedge fund. In this scenario, you use your capital to establish and operate the fund. Here are the general steps involved:

While starting a self-funded hedge fund with your money may simplify some aspects of the process, it's essential to be aware of and comply with relevant securities laws and regulations in your jurisdiction. Additionally, seeking professional advice from legal and financial experts is highly recommended to navigate the complexities of establishing and operating a hedge fund.